Why boomer business owners should watch M&A cycles

Approximately 20% of business owners are over the age of 65. Another 30% are between the ages of 55 and 64, according to estimates from the Census Bureau Annual Business Survey.

If we’re going by age trends alone, that suggests roughly half of America’s businesses will transition ownership in the next five to 10 years. This will be the

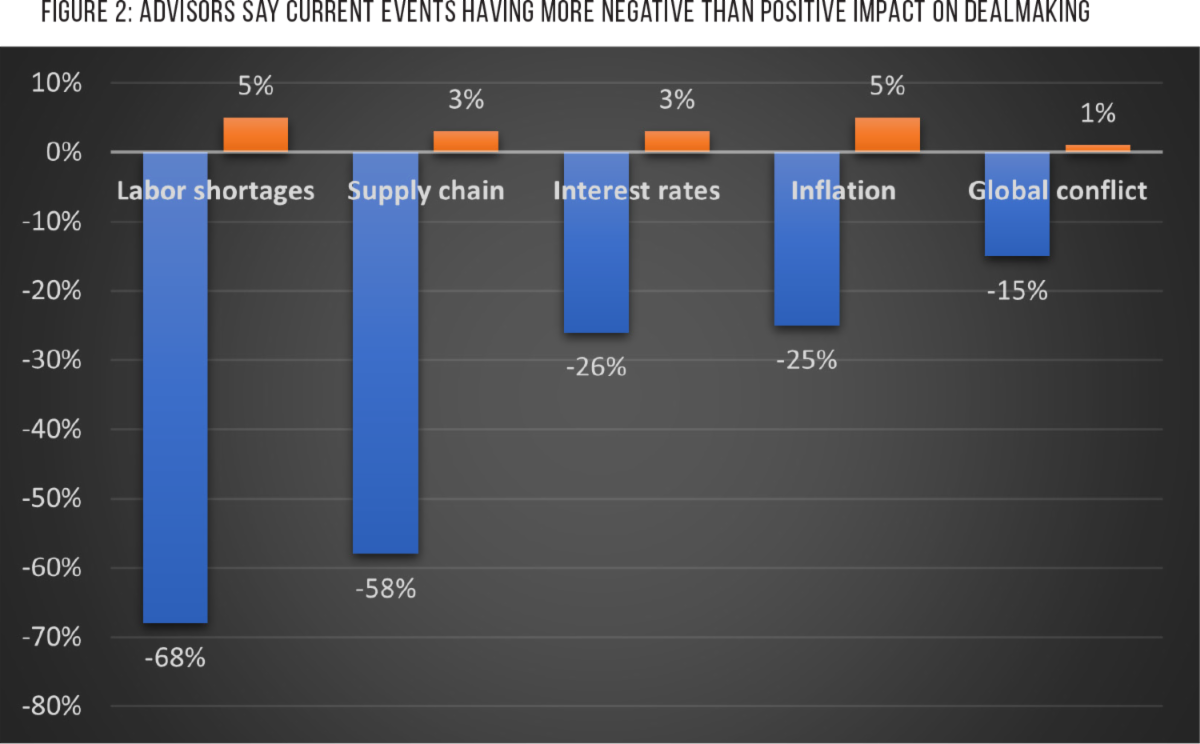

largest transfer of wealth the nation has ever seen in such a short period of time.Right now we’re in a strong seller’s market. Despite the economic uncertainty and turmoil in the world, mergers and acquisitions has not cooled down. It’s economics 101, supply and demand, and there are just more buyers than sellers on the market.Between private equity and corporate balance sheets, there’s more than $8.5 trillion in “dry powder” waiting to be invested in growth and acquisitions. That’s at least

$6.84 trillion in cash and short-term investments on corporate balance sheets, and

$1.8 trillion, in uncommitted capital in private equity, according to reports from S&P Global.Corporations

added 20% to their balance sheets since 2019, and private equity continues to up the ante with record fundraising year over year. All that cash drives up demand and increases value for business sellers.At some point, though, supply and demand could flip. Right now, experts estimate 10,000 baby boomers are retiring daily. By some estimates, roughly 15% of them own businesses. That’s 1500 new businesses every day looking for new ownership – and only a small fraction of those will get passed along to a second generation.By the tail end of this cycle, we could end up in a buyers’ market with more boomers selling their businesses than buying. Business owners who get ahead of the trend will be in the best position to take advantage of positive market conditions.Take these steps to increase your chances of a successful sale:

Plan: It’s tough to maximize value when you’re burned out, so aim to sell while you’re still energized by the business. The average sale takes nine months to a year, not including post-sale transition time.Instead of planning your retirement around a certain age, you can often reap greater rewards by timing a sale around your business value. Get a regular valuation so you know what your business is worth in the current market.If age is still your primary deciding factor, begin planning several years in advance. With enough time, your advisors can provide leadership, cash flow, and tax positioning strategies that will help you net the most out of a sale.

Prepare emotionally: Don’t underestimate the emotional impact of selling your business. Leaving an ownership role is hard, especially if you’ve built your business from the ground up.Many baby boomers struggle to step away when the time comes. Decide how you will define the next chapter in your life. It’s important to have something you’re “retiring to” instead of just something your “retiring from.”Seek advice from mentors and peers who have made a similar transition. Talk through what it means to give up your identity as a business owner. For many, it’s easier to make that transition if they already have other strong plans and commitments.

Make selling part of your succession plan: Don’t have next generation leaders ready to take over the business? Leadership team not prepared to buy you out? Consider how selling your business can play a role in your succession plan.When selling to private equity, for example, you can often arrange for family members or other key managers to receive an ownership stake in the business. This can be a great way to set your next generation leadership up for success, with strong connections and financial backing behind them.These arrangements can protect you both financially and emotionally – without the specter of money and debt hanging between you and family.

Consider staying on after a sale: Sellers can often negotiate a full time or part-time advisory role and phase into retirement. Employment contracts can make your business more attractive (and more valuable) to private equity buyers who need experienced leaders in place to maintain operations while they fuel new growth.The long-predicted seller tsunami is coming. Business was strong before the pandemic, but the crisis put everyone in a short-term holding pattern. With recession fears ahead, people are taking this opportunity to go out on a high note – while they still can.