M&A Advisor Tip

M&A Glossary: Management Presentation

In M&A, a management presentation is a meeting between a company’s owners/management team and potential buyers. The purpose is to provide the buyer with a deeper understanding of the company's operations, financial performance, and growth prospects.

The management presentation is a critical component of the M&A process, as it provides potential buyers or investors with an opportunity to assess the company's management team, their strategic vision, and their ability to execute on that vision.

Before a presentation, we will coach you on how to best present your business. We’ll have advice on how to disclose issue areas, how to highlight your team, and other tips to build buyer confidence.

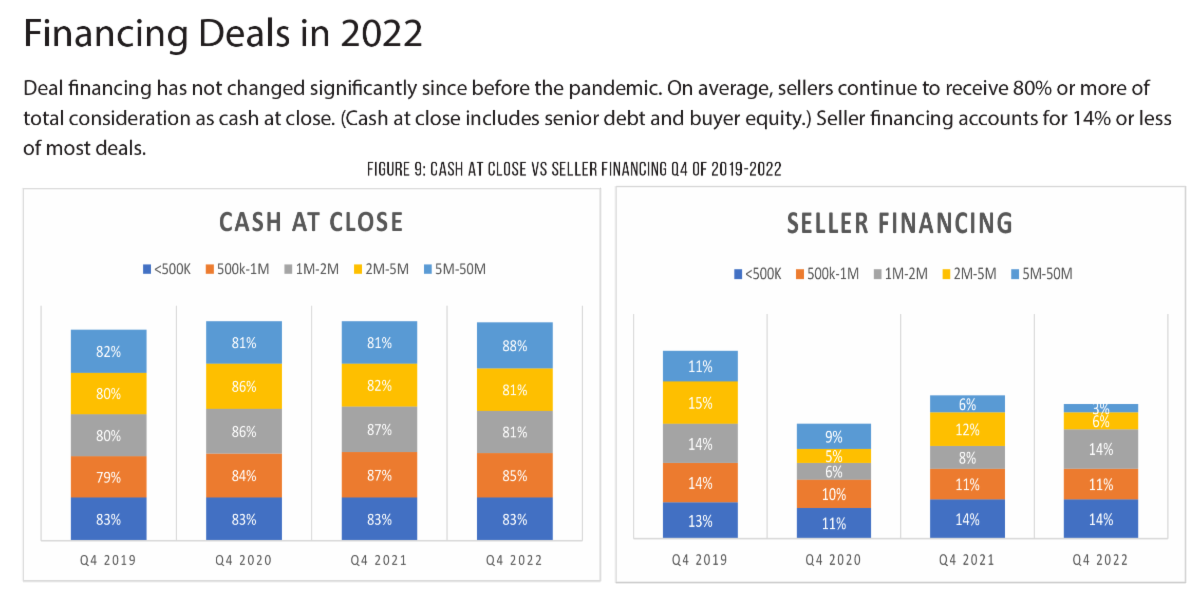

Market Pulse Survey - Q4 2022

M&A Feature Article

Fees will be a consideration, of course. But once you’re comfortable with the numbers, it’s important to understand some of the finer details of the engagement letter. When this letter is negotiated and structured well, it protects and aligns the interests of both parties.

Scope

The engagement letter will identify a benchmark number and the conditions in which the investment bank is owed a fee. (Note: The benchmark is an internal goal known only to the seller and the advisor. The business will be marketed without a published asking price.)

In a simple transaction, the owner sells their entire business at or above benchmark and receives all cash at close. But M&A transactions aren’t always that straightforward.

Perhaps the investment banker presented you with an offer that technically met the benchmark price, but structured half as an earnout (contingent on future performance). Or perhaps you have an offer to buy a majority of the business, as long as you roll equity into the new enterprise.

The engagement letter should define the scope of the transition, including what constitutes a covered transaction. Be sure the scope fits appropriately with your goals and what you would reasonably accept from a buyer.

Exclusivity and tail period

Investment bankers will require a period of exclusivity, typically a year, in which they are the only professional firm representing your business. Be aware most agreements also include a “tail period” that goes into effect if the business hasn’t sold by the engagement’s expiration date.

This is an additional period of time, typically 12 to 36 months, during which the investment banker can still be owed a fee. The tail period should apply to a defined buyer pool the investment banker identified and interacted with as part of the marketing process.

Advisors need a tail fee to protect their interests. Otherwise, a seller could wait until a buyer has been identified, then wait out the contract for the express purpose of cutting the investment banker out of their fee.

On the flip side, look closely at who’s included in the protected buyer pool. Many times, the tail period will include only those buyers who signed a non-disclosure agreement. This is a documentable way to show the buyer knew about your business because of the investment banker’s efforts.

Alternately, some advisors use broad terms, practically throwing their entire network, into their “protected buyers” list. They might say that anyone they marketed to, including any buyer or any person at any professional firm representing such buyer, would constitute a protected buyer.

So what that could mean is that the advisor mass emailed a very high-level teaser with an opportunity to acquire a “Midwest manufacturer.” Perhaps that teaser went to one advisor at the California office of a national accounting firm. Under a broad definition, that one email could tie up an eventual Minnesota buyer who simply uses a branch of that accounting firm to do their annual audit.

No one opened the email, no one identified your firm, no one even discussed the opportunity – and yet the M&A advisor has tied you up and created a way to get paid on your deal.

Included, exclusive, and reimbursable expenses

An investment banker will incur expenses as part of representing your business. According to the 2022-2023 M&A Fee Guide from FIRMEX, 60% of advisors charge extra for travel and accommodations, 31% for the virtual data room, and 15% for printing and material costs.

As a seller, look at the reimbursable expense provisions in your engagement letter. Generally, it should stipulate that the investment banker needs to receive prior approval for expenses above a certain threshold as well as approval once an aggregate of total expenses has been reached.

Pay close attention to any services that come at an added cost and any claims of exclusivity on those services. Your advisor may recommend a quality of earnings report, for example, as upfront work to prepare your business for sale. Later, you may need environmental reports, real estate appraisals, etc. Make sure you have the freedom to hire the professionals of your choice for anything not included in the engagement fee.