Advisor M&A Tip

Know Why You're Selling

As you consider why you're selling, consider your post-sale priorities. How soon do you want to be able to walk away? Would you consider remaining involved after a sale? Do you have pressing financial issues that require an immediate cash payout, versus potentially greater value recouped over time?

Get clear about why you're selling and what outcomes you want. This helps your M&A team target the right buyers and craft the right marketing messages.

You might think that the more flexible you are in your terms, the wider your potential buyer pool. But you have to be honest about what's truly going to be important at the closing table.

Market Pulse Survey - 1st Quarter 2019

Presented by IBBA, M&A Source and in Partnership with Pepperdine University

Where Are Business Values Trending?

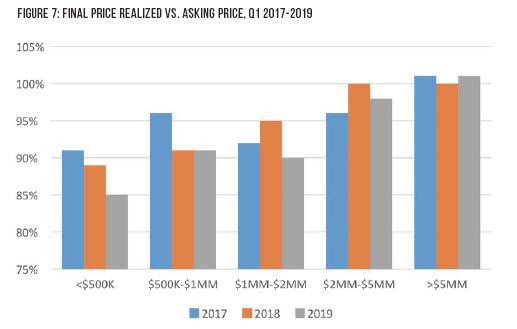

In Q1, final sale prices came in anywhere from 85% to 101% of the pre-set asking price or internal benchmark. Lower middle market companies in the $5 million to $50 million range achieved the highest values at 101% of benchmark.

"Businesses with enterprise value of $5 million of more are most in demand right now. The market is not cooling at all for those sellers," said Gary Papay, managing partner of IBG Business. "That's reflected in supply-demand sentiment and multiples."

"Typically, businesses with values of $5 million or more do not have an asking price. So those businesses have a better possibility of achieving values above the internal benchmark," Papay continued.

M&A Feature Article

It's the first time our would-be buyers and sellers get together face-to-face. It's kind of like meeting the parents for the first time. There's a lot riding on this meeting. And some sellers just plain blow it.

Physical space

Think about selling a house. You're going to mow the lawn, pull weeds, pick up, and hide away the clutter. You want to make the best first impression possible. But for some reason, so many business owners don't think that kind of stuff really makes a difference.

I've literally walked buyers through a seller's office in which half the light bulbs were burned out. I've seen shop floors in such disarray I wondered if I ought to get a tetanus shot afterwards. And I've walked into offices that looked like an episode of Hoarders, as we navigated one narrow path through papers and junk.

Even though we coach our sellers, some just won't heed our advice. They think, "This is a messy business. It's not that important." But it does matter.

If the buyer sees that half your light bulbs are burned out, they wonder what else you've let go. Is the truck fleet hanging on by a thread? Are there veritable Band-Aids on your equipment? What kind of accident is just waiting to happen in your shop?

In the case of the missing light bulbs, the owner ignored my pleas for the first two management tours. Before the third, the one with our ideal target buyer, I went to the hardware store and swapped those bulbs myself.

On arriving at his now well-lit office, the seller declared he was going to get a sunburn. But the buyer who saw the business as it should have been presented-they're the ones that ended up buying, and at a premium value, too.

Business story

Just as important as your space is how you tell your story. This is not the time to be a jokester or make light of certain issues. It's a balancing act. You want to build rapport with the buyers, but you don't want to overshare.

We always counsel our clients to be honest. If there are skeletons in your closet, you need to let us know. But there's a time and a place for everything, and the management tour is no time to dredge up old horror stories.

If the buyer asks, "How's your safety record been in the last three years," answer the question. Treat it like a deposition, focus on the time frame indicated, and then stop talking.

Do not tell the story about John who lost his finger in some piece of production machinery 15 years ago. There's no value in that conversation.

Be prepared to talk about growth opportunities. I've had sellers tell buyers that additional growth was pretty much unlikely: "I think we're doing as good as we can."

No buyer wants to hear there's nowhere to go but down. It's good to be confident and proud of what you've done, but you need to be humble at the same time. If you can't see the blue sky ahead, ask your advisor for coaching. Your would-be buyers might bring different experience, more money, or a wider network, so think about what they could do for your company.

Prep your space and prep your story. Have some practice conversations with your advisors. You've put a lot of work into building up your business, and now it's time for the big show. The management presentation is the pivot point-it's either the day your buyer confirms they want to purchase your business or the day they get scared off.

Give your place a facelift. Clean and organize. And then treat the meeting like one of the most important business meetings of your life. And save those, "Let me tell ya about this one time when...." stories for your buddies at the bar.