Advisor M&A Tip

When Someone Asks, "Are You Selling?"

As you start the sale process, you may be holding more offsite meetings and fielding confidential phone calls. Even a subtle shift in activity can cause savvy employees to wonder what's up. Be prepared to answer questions about who these advisors are that are touring your business and why you're requesting additional information from your management team.

You might tell people you're getting quotes from a new insurance consultant or lender or considering expansion plans with a potential business partner. Or be honest without telling the whole truth: You're laying the groundwork for an exit plan to secure the long-term future of your business.

If someone asks if you're thinking about selling, you can always answer with a good-natured response like this: "Everything's for sale for the right price! Did you want to make an offer?"

Market Pulse Survey -2nd Quarter 2019

Presented by IBBA, M&A Source and in Partnership with Pepperdine University

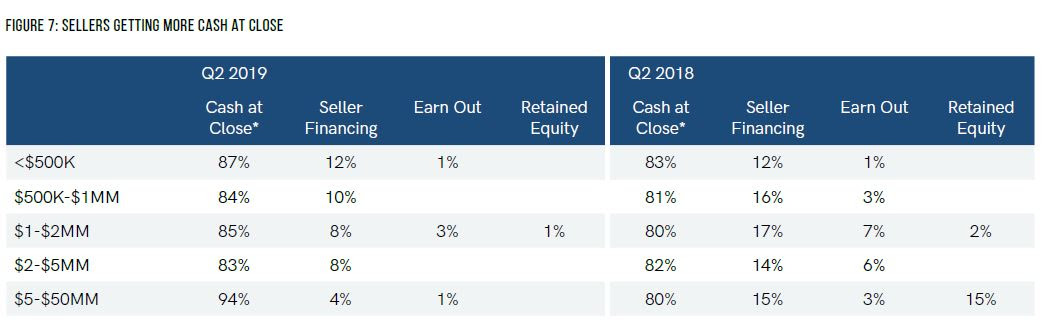

Sellers Getting More Cash At Close

M&A Feature Article

Today, we typically represent lower middle market companies with an enterprise value of $5 million to $50 million. At that size, fewer business owners consider trying to sell on their own. They understand that selling is a complex endeavor and that specialized advisement can increase their value, far beyond our success fee.

These days, we have a lot more hurdles in terms of seller education. Lower middle market businesses are highly attractive to private equity and strategic buyers right now. More competition means more options for sellers. It's not just higher values but varied deal structures, recapitalization opportunities, and even minority ownership sales. Selling doesn't have to mean exiting.

Another key message I'm always trying to drive home is that there's real value in planning ahead. When you know what your business is worth, what buyers are looking for, and where the M&A market is trending, you can build a sought-after business that will have buyers lining up to acquire you.

Know Your Value

Part of building a saleable business is knowing how much your company is worth. I believe business owners should get an estimate of value every couple of years, even if they're not planning to sell anytime soon.

Time Your Sale

Many business owners figure they'll sell when they hit 60 or 65. They focus on their age as the target, ignoring industry trends, the financing environment, tax laws, or the M&A market.

If I had my wish, I'd ask every business owner to go through this exercise: Decide what kind of lifestyle you want after your business is sold.

Then, work with us to get an estimate of value on your business. Next, take that number and talk to your CPA to figure out the tax ramifications of a sale. Finally, talk to your financial advisor to understand what you'd need to live your ideal life.

Once you have all that information you can make a truly informed decision about when to sell your business. If you know your value in today's market, and can live the kind of life you want, it might be time to take your cards off the table and guarantee some financial security.

Selling your business doesn't have to be about retiring. (You don't even have to leave right away or sell 100 percent.) It should be about diversifying risk and maximizing your return on years of hard work.

Anyone who's been through the last 10 to 20 years knows market conditions can change on a dime. Your business could be worth less tomorrow, through absolutely no fault of your own.

So, if you're timing a sale against your age, and the market drops on that milestone birthday, you'll have to decide between selling in a downturn or holding on and working longer than intended-many times another five years or so.

Build Your Team Early

To get what's most important to you, you want to bring more than one buyer to the table. An M&A advisor helps you do that by creating a confidential, auction-like environment for your business. In the last year, we averaged over three offers per client in the lower middle market.

When it comes to positioning a business for sale, there's a lot we can do to optimize your company, if we have adequate time. Adjustments to your working capital alone can mean hundreds of thousands in value at the time of the sale.

You only get one chance to sell your company. Make it your business to maximize value and go out on a high note. Talk to us about how to make that happen. Give us a call for a confidential discussion, even if you don't plan on selling for years. We want you to be successful, and that starts with gaining knowledge and planning ahead.