M&A Advisor Tip

Deal Killers: Loss of Key Employees

If you have certain employees who are critical to operations and would be hard to replace, take steps to secure them before a sale.

Noncompete contracts can be one way to reduce employee defections. Take a look at your employee agreements, too, and ensure you have appropriate non-disclosure and “no raid” covenants.

Give careful consider to “stay bonuses” as well. Provide an incentive for employees to stay for a period of time post-closing. Talk with your advisors and buyers about other incentives, such as stock options, which can minimize defections.

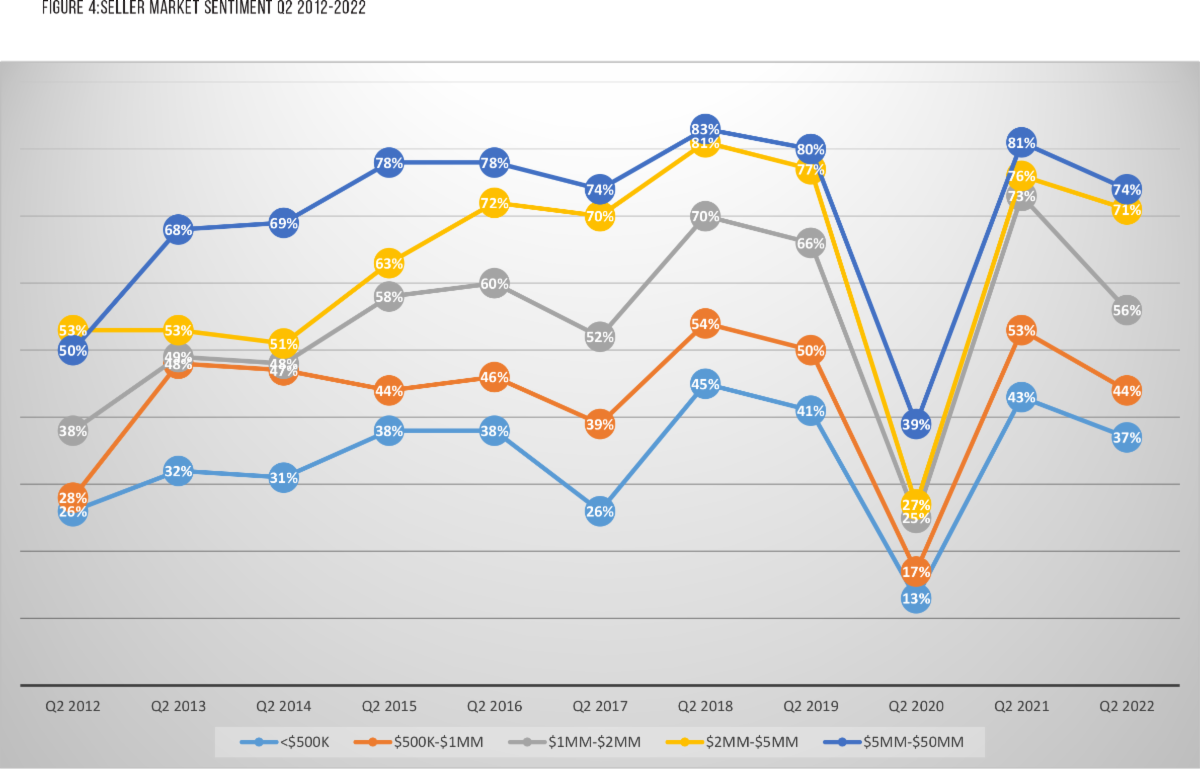

Market Pulse Survey - Q2 2022

M&A Feature Article

Real estate principles apply, so you’ll want to clean house and maximize your curb appeal. But that’s not all that goes into a successful business sale. You need to “clean up your act,” so to speak, and address some operational issues that may not have been a priority for you over the years.

Clean up your financials. Many business owners run their monthly financials in QuickBooks or similar software. These financials may not be reconciled on a monthly basis which means you’re often correcting entries throughout the year.

Buyers need to rely on the numbers presented, so check your accuracy and correct errors so there are no surprises during the due diligence period. We see companies with placeholder or oddball accounts too – things like “See Accountant” or “Undeposited Funds.” These accounts should be reviewed and cleared out before presenting your financials to potential buyers.

Trim your working capital. Working capital is always a negotiating point when selling your business. A small business may be sold with no working capital beyond inventory. But for a lower middle market business (those with values greater than $5 million), buyers expect you to sell the business with enough working capital to operate.

There are different definitions of working capital depending on your specific scenario, but the most basic definition is Account Receivables(A/R) + Inventory – Account Payables (A/P). You’re generally better off when you can minimize working capital because it means you’ll take home more out of the business at the end of the day.

Look at your aged accounts receivable, and either try to collect on older balances or write them off. Send out invoices in a timely manner and work with customers, as appropriate, to bring those payments in faster.

Review accounts payable as well. Are you paying bills faster than you need to? It’s not uncommon to see long-standing business owners in a comfortable cash position get complacent about how they’re managing their working capital – paying bills quickly and collecting slowly. Think about how you can make the best use of other people’s money without jeopardizing relationships. It will pay off when it comes time to sell.

Clear out excess inventory. We also see a fair number of businesses operating with excess inventory. When demand is strong and credit is cheap, many businesses use that credit to buy inventory. After all, the more inventory you have, the more flexibility you have in production, and the more responsive you can be to customer demand.

If you’re planning ahead, think about right-sizing your inventory in the last couple of years before you sell (good business information systems can help). Too much inventory inflates your working capital. If you don’t get disciplined about inventory, you can always try to tell buyers, “Yeah, you don’t really need that much.” We can make that argument, but it’s a fight to get an adjustment.

Inventory issues aren’t just about “excess” either. Sometimes the real problem is “dated.” if you’ve been squirreling away excess inventory for years, beware. Buyers may not pay for outdated inventories that you thought you might sell someday. Make sure your inventory is in salable condition and has value to a buyer.

Close out legal issues. Check for outstanding judgements or legal issues that haven’t been resolved or taken off the county records. Your attorney can help perform a search and satisfy these issues, so they don’t slow down your business closing.

Pay attention to employee issues, as well. Do your best to resolve any pending suit, settlements, or workers comp matters.

Spruce up fixed assets. Finally, take a critical look around. Is your signage in good shape? Are the shop and yard clean? Are you portraying a professional appearance with your buildings, vehicles, and equipment? Mess and disorganization can chase a buyer away.

Aging assets can also be a problem if they’re critical to the business. If a buyer thinks they will need to replace essential vehicles or equipment after closing, then this will definitely be reflected in their offer to purchase.

Then again, tread carefully when considering other major, non-essential purchases before the sale of your business. You need to run your business as if you are not selling it. However, making major investments right before you sell (to save tax dollars, for example), is usually not a smart move as in most cases you won’t recoup your money back out of your investment.