M&A Advisor Tip

M&A Glossary: Cash at Close

This term refers to how much cash the seller receives the day the transaction closes. Sellers typically receive the majority—but not all—of the purchase price as cash at close. Additional proceeds may come later in the form of payments on a seller’s note (a loan you make to the buyer), earnouts, or other delayed compensation structures.Top deal challenges in lower middle market

M&A Feature Article

And yet, according to the Q1 Market Pulse Report from IBBA and the M&A Source, the lower middle market is bucking those trends. Deals are closing faster, and businesses in the lower middle market are still selling at 97-98% of benchmark.

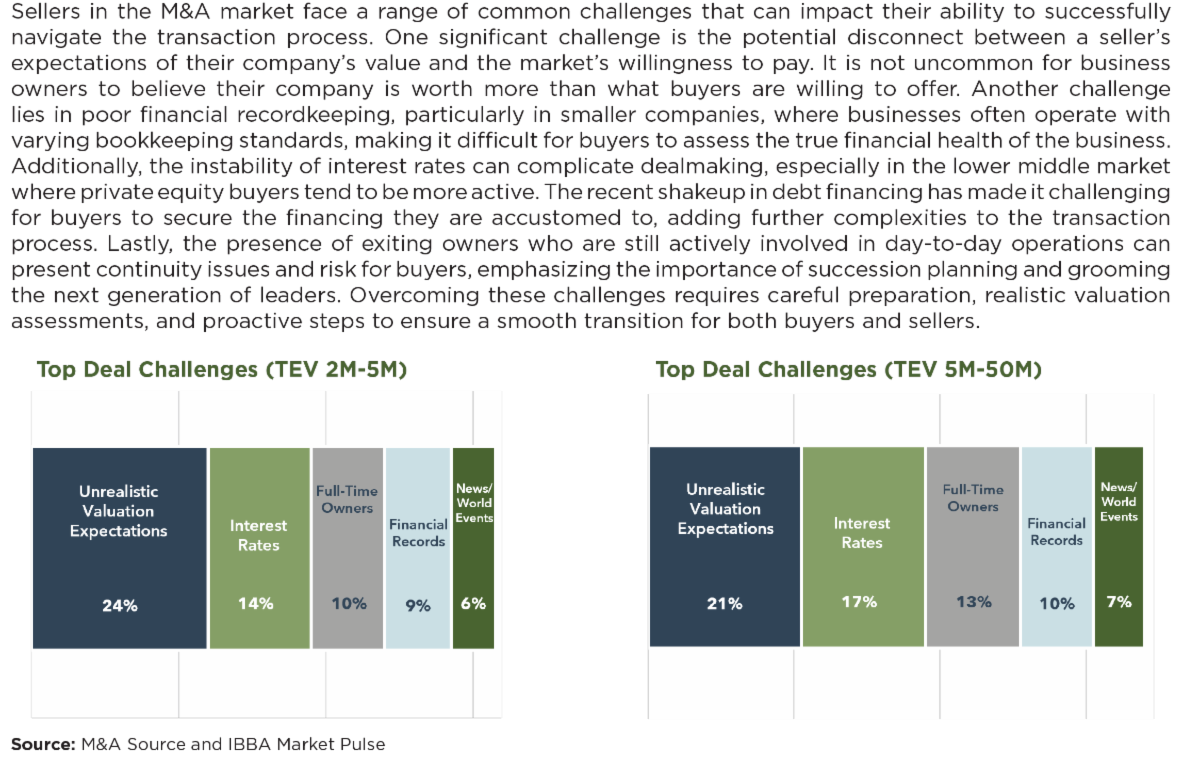

In the Market Pulse report, roughly half of the M&A advisors surveyed said the banking crisis had no impact on their clients, and only 6% said it had lowered business values. Meanwhile, interest rate instability also had limited impact, with only 15% of advisors saying it was creating a challenge to getting deals done.

The lesson here is that big market trends don’t always trickle down. If you own a small or medium business, don’t let the global M&A headlines color your outlook for the year ahead. Talk to specialists on the ground and find out what’s happening in your market:

Market dynamics: The lower middle market remains active, with lenders willing to provide financing. Buyers are increasingly shifting their focus to downstream (i.e. smaller) opportunities where the lenders are still able to support dealmaking.

It is true that new deal volume experienced a slowdown in late 2022, persisting into the first few months of 2023. But around mid-April, many lower middle market advisors reported a sudden surge in seller inquiries. Sellers, who had been hesitant to enter the market for the past six months, have returned. This resurgence is particularly welcome as the industry was experiencing a shortage of available inventory.

Flight to quality: In an uncertain market, we see a flight to quality. That means buyers are increasingly hesitant to take big risks, and are focusing their efforts on stable, proven acquisition opportunities. This also means that the sellers who properly prepare their company for sale are seeing bigger benefits.

In other words, good businesses are selling. One Wisconsin technology company, for example, attracted interest from over 100 potential buyers. They received more than 20 written offers, several above the benchmark.

In Texas, a machine shop received a 7.5 multiple on its $5 million EBITDA–for a transaction value of $37.5 million. That multiple, nearly unheard of for a machine shop, was helped along by the company’s investment in automation. They have the ability to run lights out, meaning certain elements of production can run overnight without on-site staffing.

Shifts in deal structure: While valuations have remained relatively stable, there has been a slight shift in deal structure. Buyers are increasingly seeking to transfer some risk to sellers. This takes the form of seller notes, earnouts, or equity rollovers—options which provide friendly debt or performance-based payment plans to bridge any valuation gaps.

Sellers, in turn, appear more willing to take on additional risk to achieve higher valuations. These adjustments reflect trending negotiation strategies in the current market climate.

In the Midwest, for example, two companies in the marketing space attracted multiple offers. Each of these deals included a portion of cash at close with the rest structured through multi-year earnouts. In one, the seller had the choice between a benchmark offer with 80% cash at close, or an offer with 60% cash at close but a five year earn out opportunity tied to sales that would approximately double the benchmark. The seller chose the larger upside, as it benefited both her and the minority owner on her leadership team.

Reshoring: The manufacturing sector is gaining momentum, driven by an increasing interest in reshoring. With the supply chain lessons of COVID-19 (mostly) behind us, businesses are recognizing the benefits of localized production and supply chains.

In Canada, one plastics manufacturer talked about winning new business that customers had previously outsourced to Asia. While “Made in America” has always held a certain appeal, he’s hearing from customers that “Made in North America” is increasingly gaining prominence.

In conclusion, while global M&A headlines may convey a sense of uncertainty, the lower middle market continues to exhibit strength and resilience. By staying attuned to market dynamics, emphasizing quality, adapting deal structures, and staying nimble, small and medium-sized business owners can maintain business value and maximize their exit options.