M&A Advisor Tip

Make contracts assignable

One key factor that significantly impacts the value of any contract is whether it’s assignable.

Don’t put yourself in a position of negotiating assignability at time of sale. It eliminates confidentiality and opens the door for customers to highjack your deal. Knowing your company is for sale—and that the sale is dependent on their contract—shrewd customers will ask for lower prices or more favorable terms, knowing you’ll likely agree to anything reasonable. You and your buyer both lose.

Not all industries lend themselves to contracts. Secure them if you can and work with your attorney so you can transition those agreements to a new owner...without asking customer permission first.

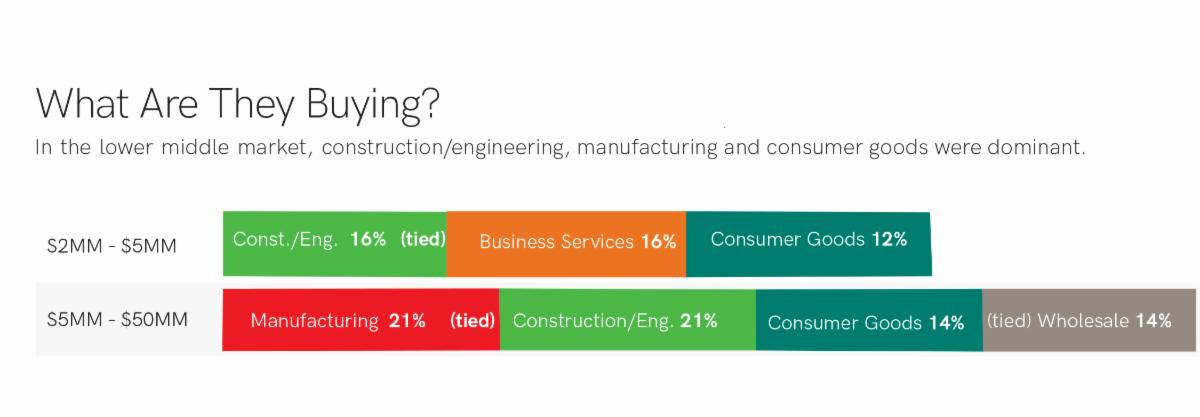

Market Pulse Survey - Quarter 2, 2021

Presented by IBBA & M&A Source

M&A Feature Article

At first, the sellers thought they wanted a full exit, all cash at close. If they were going to give up control, they figured it was best to cash out. But as they continued to talk with potential buyers and partners, they began to consider a majority recapitalization.

In a majority recap, the owners sell a majority interest to investors who provide a cash infusion. The sellers maintain a meaningful minority stake in the business and, typically, continue to manage the “recapitalized” operation.

In this transaction, the sellers got 90% of company value as cash at close, rolling over just 10% of their proceeds into the new company. But because of the debt structure on the new entity, that 10% actually translated into a 20% ownership stake.

A typical model for investment buyers like private equity firms or family offices is to put roughly 50% debt on the new company. This allows them to leverage their equity and generate a better return. Through that debt arrangement, the value of the sellers’ rollover essentially doubled to 20%.

Majority recaps are a way for an owner to diversify their net worth while also getting a strong financial partner who will help grow the business. Typically, these transactions are structured so that the seller (aka the new minority owner) holds no personal guarantees on the debt.

So worst case scenario, if the company goes totally south, they’d only lose that 10%. No one could go after the 90% they already took out of the business. It’s like the seller gets to take their chips off the table and play with the “casino’s money”.

Value today. Business valuations are strong today. Market conditions are such that there are a lot of well-funded buyers out there looking for opportunities. We’re in a seller’s market and people are seeing values trending at or above previous benchmarks in their industry.

What that means is that the 90% cash at close our sellers took in this deal was probably worth as much or more than a 100% sale would have been worth a few years ago.

Value tomorrow. As we say in M&A, majority recaps provide the seller with a “second bite of the apple.” That second bite typically occurs four to seven years after the initial recap.

After a period of investment and growth, the majority and minority owners agree to liquidate value (i.e., “re-sell” the business). If performance has been good, the owner’s minority shares could be worth similar and sometimes more than they received in the original transaction, depending on how much equity they roll over.

Gain or give. For some sellers, that extra minority stake in the business is really bonus money. We sometimes see sellers use deals like this as a way to transition ownership to their children or their management team. (Note: Roll over equity could be 10%--49%).

It’s a way to provide people with a meaningful ownership stake and opportunity for growth – without risking their own financial future in the process.

Control issues. When considering a majority recap, understand the role your new partners will want you to play in the business. Sellers think, “I’ll be a minority owner and I won’t have control anymore.” While technically true, it’s not the reality of most relationships.

Financial buyers (i.e., investors) are not looking to come in and take over your business – not if they can help it. These buyers prefer companies with strong management teams who have a vision for the future. They want to support the team that will grow the business – not control them.

The takeaway here is that you have options when selling your business – lots of options. Sell and exit right away, sell and stay, minority stake, majority stake, control, consult, gift, succession plan. It’s all on the table in today’s M&A market.