M&A Advisor Tip

Buy your buddy a beer, not experience

I’m all for friendships, but I wouldn’t risk my financial future on one. Unfortunately, many business owners do just that. If you’re like me, many of your professional advisors have become your friends, and you want to honor those relationships.

But M&A is a specialist’s world. If you engage your usual advisor (e.g., attorney) to conduct a business sale and they are not a specialist in M&A transactions, you could be risking everything you worked so hard for. Think of this as brain surgery. You wouldn’t use your general doctor who has done your annual physical for the last 25 years. So why would you not bring in a specialist with the largest financial transaction of your life?

Find someone with the right experience to protect you, your family, and your employees. When the sale is done, you’ll have the resources to throw some new business (and some beers) your friend’s way.

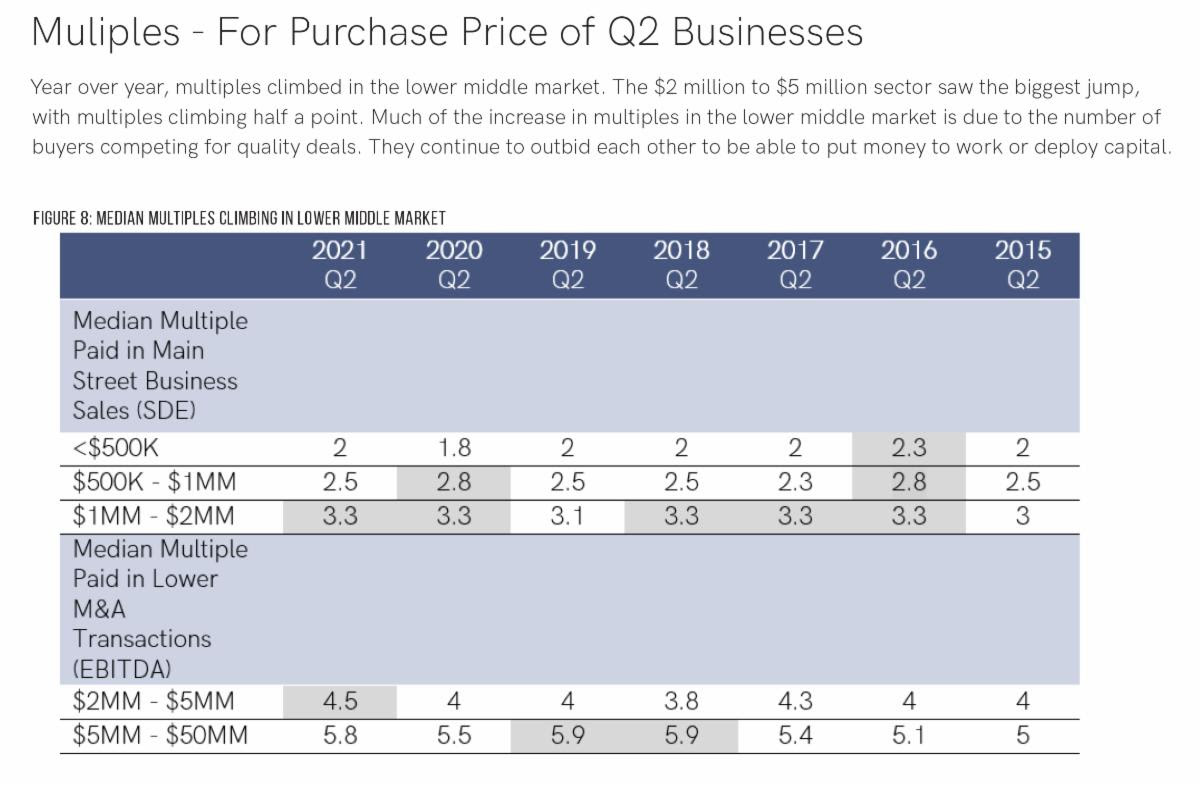

Market Pulse Survey - Quarter 2, 2021

Presented by IBBA & M&A Source

M&A Feature Article

Employee issues, specifically longevity, loyalty and work ethic, ranked ahead of other due diligence priorities like operations, revenue and customer concentration.

We’ve been hearing from sellers for a couple of years now that finding qualified employees is their number one barrier to growth. Many can’t find the talent they need to meet customer demand, much less open new divisions or expand to new territory.

This shortage of good talent is also one contributing factor in the strong M&A market right now. When businesses can’t grow organically, they look to acquisitions as a path to expansion. That’s why buyers are putting increased scrutiny into the quality of a company’s employee team.

As an industry, we’ve been talking for years about how important it is to have a well-developed management team in place before you sell. Buyers want a leadership group – or at least one key manager – who can maintain the business in the owner’s absence.

What’s interesting, is that in the recent Market Pulse Report, management team ranked number five on the buyer due diligence list. A good succession plan and backup support is still incredibly important to the saleability and value of your business, but it seems that the strength of your overall employee team is – at this moment in time – an even bigger priority.

Here are some of the issue areas buyers are looking at:

Retention. How long do employees stay with you? What practices do you have in place to keep people loyal and committed to your organization? People stay with their employer for more than salary and benefits. Buyers need to understand why employees are loyal so they can make sure it’s a good fit for their own culture and expectations.

Culture. Do employees have an ownership mindset? Do they pitch in and support each other in times of need? Have they build a self-policing culture of quality and performance? And again, will the factors shaping that culture mesh with the buyer’s workplace?

Learning and development. Millennials are currently the largest percentage of the U.S. workforce, and this employee group, more than any other, cares about training and growth. Workplaces with established learning and development programs, as well as those with an organic culture of internal mentoring and promotions, will win employee loyalty – and points with buyers.

Cross-training. COVID-19 shone a spotlight on the benefits of cross-training. When business conditions are changing rapidly, it’s critical to have the ability to move employees from role to role. What’s more, cross-training benefits your people by broadening their skillsets and enabling more flexible scheduling.

Cross-trained employees are better able to fill in and cover for colleagues who want time off, who need extra help during a busy shift, or those who are sick or quarantined and unable to come into work for an extended period of time.

Niche, high-demand skills. In a tight talent market like this, an acquisition can be a way for a company to gain access to highly skilled talent. In some cases, this can even be the primary reason for an acquisition.

If you have employees with hard-to-find skills and employees who could take on new challenges and help a buyer grow, think about how you can retain them and keep them engaged in the run-up to selling your business. That said, we generally do not advise disclosing your exit plans to employees in advance.

A pending sale can cause anxiety among your employee group. Some will look for a new job rather than risk an uncertain future with a new owner. Talk to your M&A advisors about your key employees, stay bonuses, and what kind of succession planning is right for your situation.

Depending on your exit goals, we may be able to target buyers who will offer small equity positions to key employees. For the right employees – the opportunity to gain a real ownership stake in your business could be a meaningful incentive that keeps them committed to your company.