M&A Advisor Corner Tip

Cross-training and Succession Planning

A strong management team has long been one of the hallmarks buyers look for in a business. And now, in the era of COVID-19, buyers will be increasingly interested in issues of cross-training, succession planning, and leadership development. Buyers will be looking at how the business could be impacted if health issues, or quarantine requirements, prevent certain team members from working.

Review your succession plans and cross-training efforts now to alleviate concerns about key talent.

Market Pulse Survey - Quarter 1 2020

Presented by IBBA, M&A Source & in partnership with Pepperdine University

Most Businesses Partly Open

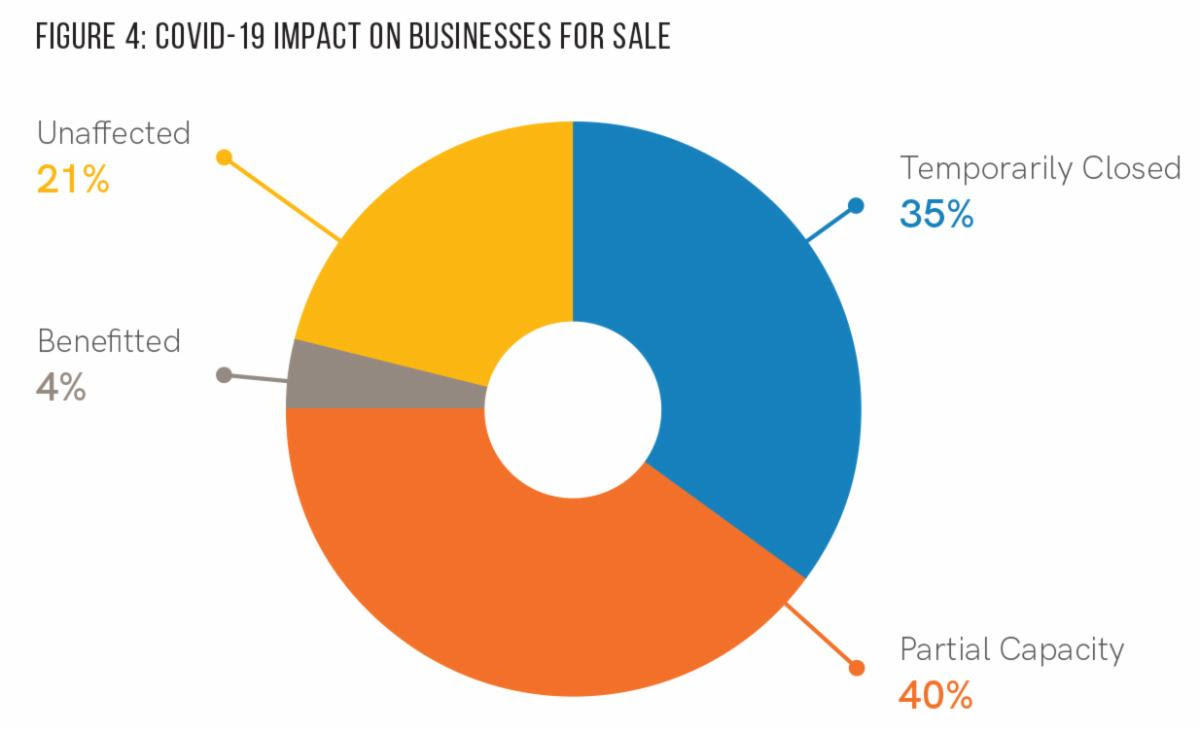

Overall, business brokers and M&A advisors report that many (40%) of the businesses they represent are operating at partial capacity, while 35% have temporarily closed, 4% have benefited, and 21% remain unaffected.

M&A Feature Article

According to the Q1 2020 Market Pulse Reportpublished by the International Business Brokers Association, M&A Source, and the Pepperdine Private Capital Market Project, advisors reported that of the small and medium businesses currently for sale, about 35% had closed, 40% were operating at partial capacity, 4% had benefited, and 21% remained unaffected by COVID-19.

Not surprisingly, the pandemic caused a delay in business sales. Advisors indicated 46% of lower middle market deals were delayed in Q1 and 11% were cancelled altogether.

For deal cancellations, 25% were attributed to sellers pulling their business off the market. Nearly half of the cancellations (46%) were due to buyers backing out, and 12% were due to changes in bank financing.

For business owners, the COVID-19 pandemic was like getting punched right between the eyes. It knocked people down. And even when someone could stand up again, their head was still spinning. But now, we're starting to see those cobwebs clear.

In March, advisors like us saw an instantaneous drop in buy-side activity. Buyers with retainers for proprietary deal development stopped their accounts. Here at Cornerstone, we had some new buyer conversations in April, but nothing solid. By May, though, we started to see a resurgence.

Valuations

The question now, as buyers move forward with acquisition plans, is what will happen with valuations.

For those businesses that remained fully active, their valuations will likely stay solid. But even those businesses that partially closed or negatively affected may find valuations remain consistent. Businesses that were essential or otherwise able to pivot to an online or contactless business model will be attractive to buyers.

And while declining cash flows typically do impact business values, we may see special considerations granted for the pandemic.

Most business sales are calculated as a multiple of adjusted cash flow or EBITDA. However, a typical part of the calculations involves "normalizing" cash flow. That means making adjustments for one-time expenses and unusual events.

As buyers and lenders value your business, they may apply the same normalizing adjustments to your financials for COVID-19, especially if you can recover quickly in Q3 or Q4.

Deal structure

In terms of deal structure, though, sellers who want to get full value from their business will likely have to carry more risk. Buyers may ask for more in seller financing, earn out, or equity rollover in order to lessen the risk of future declines.

Here's what that might look like:

Seller financing.Seller financing is the bridge between a buyer's resources and the value they see in your business. Essentially, it's a loan from the seller, typically structured with monthly payments over a three to five-year period.

In the past year, seller financing has hovered between 10-15% for Main Street deals, and 6% or less for deals over $5 million, per the Market Pulse Report.

The larger the risk (e.g., COVID-19 closures), the more seller financing a buyer will request. So, I expect we'll see these numbers climb in the year ahead.

Earnouts. An earnout is a commitment by the buyer to pay the seller a certain amount of money tied to future performance after a sale. If the business meets certain benchmarks, you get additional value. Earnouts, however, cannot be used in conjunction with an SBA loan, and that makes them less common in Main Street deals.

Equity rollovers. In this arrangement, the seller maintains an ownership stake in the business. They roll a portion of their equity stake into the new capital structure in lieu of cash proceeds.

These arrangements are common with financial buyers, such as private equity and family offices. These buyers generally acquire businesses with the intention of holding them for five to seven years before reselling at a profit.

Financial buyers often want sellers to receive a portion of their consideration as equity. It's part of their typical financing model, and it's a sign the seller has faith in the business.

For sellers, an equity rollover means you get a second bite at the apple years down the road when the business sells again. In some cases, if the new owner has successfully grown the business, your minority stake could be worth as much as your original sale.

Deal structures will also be driven by lending activity in the months ahead. If lenders pull back, both buyers and sellers will be motivated to reach alternative financing agreements.